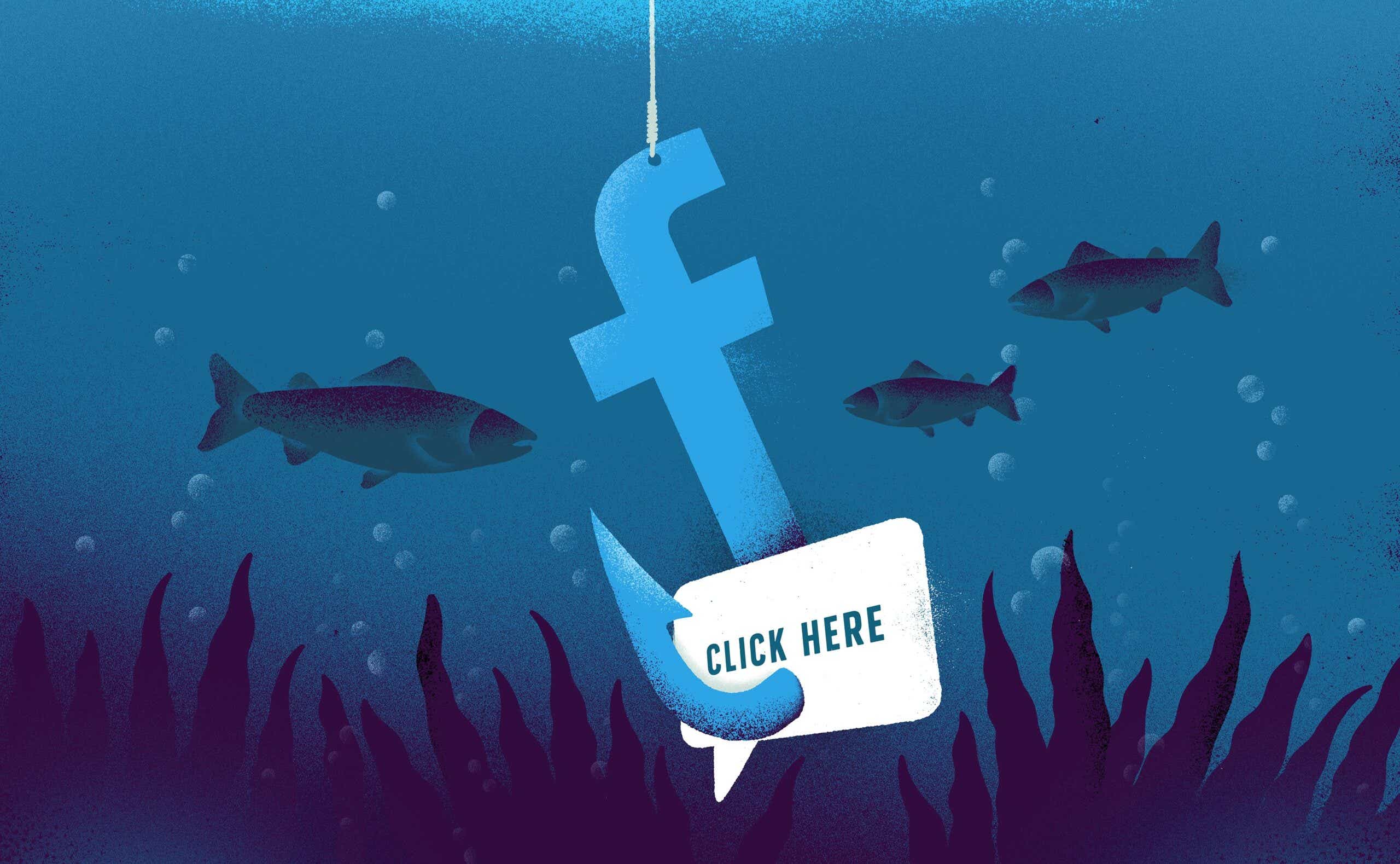

The most common scams on Facebook, Instagram, and other apps.

There are definitely some upsides to social media, like keeping in touch with distant friends and family and finding funny videos. But there’s also a dark downside, and we’re not just talking about how it can be a total time suck. Sites like Instagram and Facebook are practically gold mines for scammers looking to pocket a quick profit.

You might be saying to yourself, “well, of course, I would never send money to a stranger claiming a foreign prince trapped in another country,” but scams aren’t always that easy to spot and even the savviest social media users can fall victim to them.

Though seniors have traditionally been targets of online scams, Bankrate.com’s senior industry analyst Ted Rossman says hackers are getting increasingly more cunning and anyone can fall victim to these schemes, including young people. (In 2021, the Federal Trade Commission reported that 44 percent of people ages 20 to 29 lost money to fraud, which is more than double the 20 percent of people ages 70 to 79.)

“Seniors are hardly the only targets of scams,” Rossman tells Katie Couric Media. “Young people don’t have as much life experience and therefore could be vulnerable.”

Wondering how to stay safe without completely shutting yourself off to the digital world? Here are some ways to steer clear of social media fraud, especially ahead of tax season.

Beware of the different types of scams

Scams come in many different shapes and sizes, and some scammers are seriously creative. (Maybe that’s why they call them “artists.”) Rossman says young people are “especially vulnerable” to social media quizzes and games. Even though taking a test to determine which character from your favorite TV show you’re most like can seem fun and harmless (not to mention possibly life-changing), he warns that you could be unwittingly inviting a hacker to install malware onto your computer or handing over sensitive information like your address that can be used to steal your identity.

Another one to watch out for is romance scams. Rossman tells us that singles in their 30s, 40s, and 50s are often targeted by swindlers because they’re thought to be lonelier and more vulnerable compared to those in relationships. Unfortunately, the rise of dating groups on Facebook has only made it difficult for many people to weed out a potential love interest from a scammer. This information might tempt you to completely shut down your quest for companionship, but Rossman’s recommendation is pretty simple: Take things slowly by asking a lot of questions and remain leery of anyone who starts asking for money or personal data.

“A common trick for scammers is saying they fell in love with you quickly and asking for money or for you to buy them a plane ticket so that they can visit you,” he says. In case you needed another reason to avoid a slightly desperate-seeming suitor, Rossman says: “A red flag would definitely be if somebody’s over-eager and jumps in too fast.”

Then there’s the get-rich-quick scam. No, we’re not talking about that high school classmate who keeps messaging you about joining their group of “badass business ladies making millions from their couch” — although, we’d argue that’s also a scam. But this one would come from an unknown con artist reaching out and immediately asking you to send money through something like Zelle or Venmo to make a profit off some brilliant product they invented or for their coaching services that’ll turn you into an overnight success in the field of your choosing. What makes peer-to-peer apps like Venmo particularly dangerous is they can make money much harder, if not impossible, to trace compared to traditional credit or debit cards. So if you’re going to send money this way, Rossman says to make sure it’s to people you’ve met and know.

Watch out for distress messages

You should be wary of anyone who reaches out to you claiming that they’re in some sort of urgent situation. Though these can vary, Rossman says sometimes they often pose as friends, family, or someone you know, but the one thing they have in common is they need money — now.

“There are various ways that a fraudster can get you to let your guard down,” Rossman tells us. “I’ve even heard of situations when they’ve spun a fake social profile of somebody that you do know and then they come up with some story about, like, your best friend being stranded somewhere and needing money.”

Before you even consider responding, make sure you reach out to the friend or loved one in question directly to make sure their account hasn’t been hacked or in any way compromised. They might be perfectly fine, enjoying a stroll and a scoop of ice cream.

Be suspicious of everyone

While it’s easy to ignore friend requests from strangers, don’t immediately trust that someone is who they say they are. Rossman tells us that fraudsters often pose as government officials and pretend to work for the Internal Revenue Service. For instance, you might get a message or friend request from someone trying to “alert” you, claiming that you owe money on back taxes. While it might seem like common sense to ignore a request like this on an app meant for leisure, not official activities, you might be surprised by how convincing they can be. (“We’ve been trying to reach you,” they’ll claim.)

Rossman adds that what can make it especially confusing is they already have some kind of information on you, such as your birthday or the last four digits of your credit card number before tricking you into divulging the rest of your information.

“Sometimes people just kind of freak out and they hear like, ‘Oh, the IRS is after me,’” says Rossman. “Oftentimes, they’re not really thinking clearly, and I’ve heard plenty of stories of otherwise intelligent well-meaning people that have gotten swindled by various versions of this.”

Take the necessary precautions

While certainly annoying, changing your social media passwords often is important to avoid getting hacked. Rossman recommends making a new one every few months, which he acknowledges can make it hard to keep track of them. That’s why he recommends using a password aggregator like LastPass or Dashlane. “They do the hard work for you, setting and remembering strong, unique passwords,” he tells us.

But if you prefer to come up with your own password, he recommends taking special care with sensitive accounts like your bank account. So, for instance, you don’t want to use the same password that you have for your social media accounts for your banking. “If your social media accounts are compromised, you could have a bigger problem if your financial accounts are impacted as well,” he says.

If you want to feel even more secure, setting up two-factor authentication on your social might not be a bad idea. In case you’re not familiar with this security process, it involves verifying your identity by using two forms of identification to access your account, such as a phone number or an additional password. But Rossman doesn’t think this extra step is completely necessary.

“It could certainly help, but I find that a lot of people get overwhelmed when considering data security protocols,” he says. “If you can’t do everything – and let’s face it, most people probably don’t want to spend a ton of time or attention on this – I’d suggest focusing on the big stuff.”

What else can we do?

As uninspiring as this may sound, creating more awareness around scams can at least help offer a solution. After all, Rossman says most scams, including some that might even rise to the level of a police report, often go unreported because the victim is too embarrassed to admit they were conned. But the reality is it can happen to even the best of us. So, while you might feel embarrassed, telling your story could help others avoid a similar situation.

Rossman has one simple tip for not getting swept up in the social media multiverse: “It’s important to just take a breath with all of these situations,” he says. “Sometimes, in the heat of the moment, people end up oversharing or making a mistake, so it’s important to slow down.”