A mom laments the loss of the American Dream, but is it that simple?

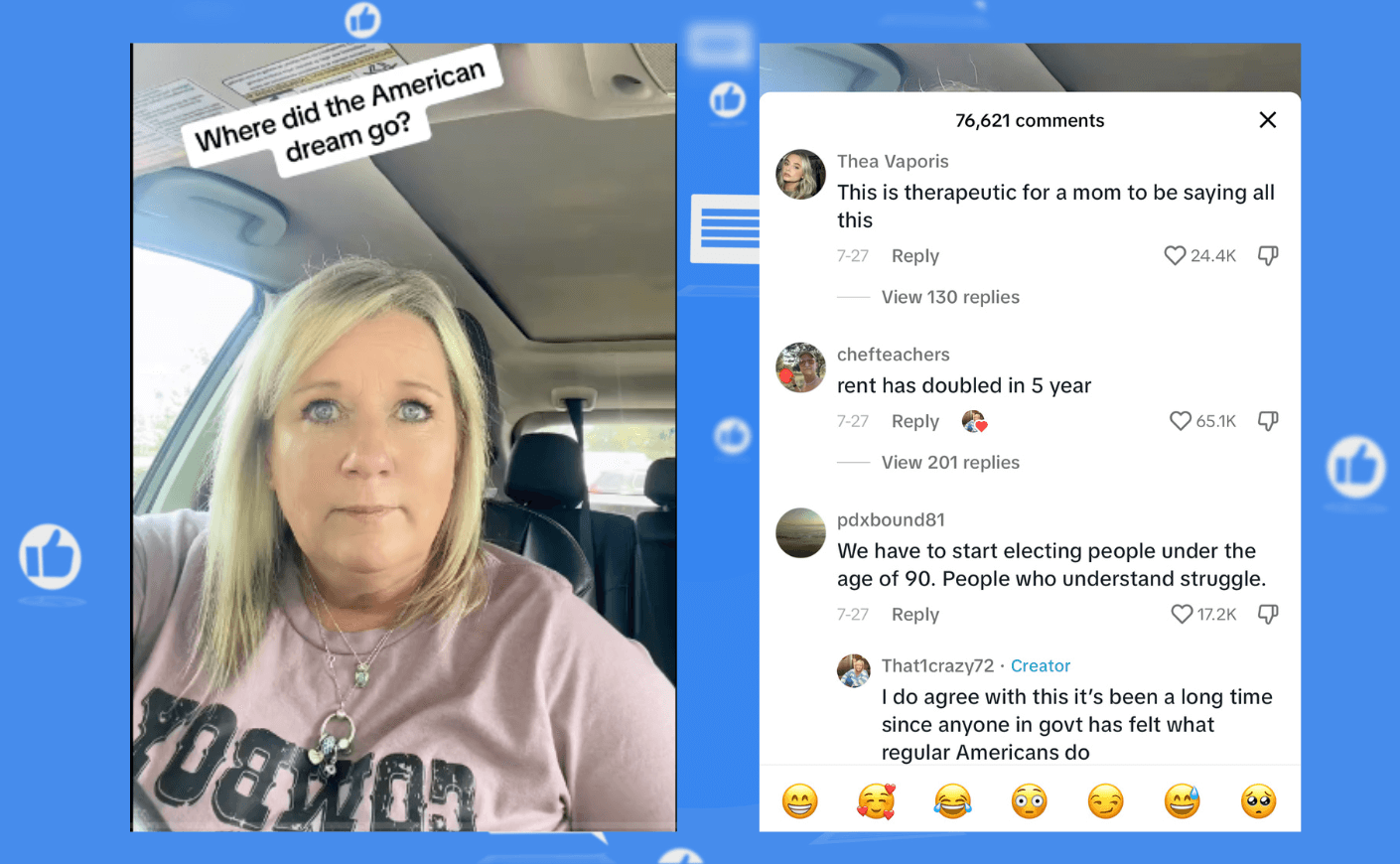

A Gen X mom on TikTok amassed millions of likes recently after a fantastic soliloquy calling out the financial injustices her adult children face … and how having them at home is really cramping her goal of empty nesting.

The surprising twist? She gets it: She’s not frustrated with her kids, she’s furious with the direction of our economy, and how despite telling her son and daughter to “work hard,” they can’t seem to earn enough to move out and start adulting. “Worked for me, why wouldn’t it work for them?” she said. Her primary question: Where did the American Dream go?

Finally, a 50-something parent who’s come to terms with a hard truth many young adults already face: Life is wicked expensive these days.

It’s exponentially harder for Millennials and Gen Z to achieve financial independence at the same rate and pace as their parents once did. The cost of living — including everything from housing to health insurance — has soared at a rate far faster than wages over the past decade.

And the cost of a college degree today, which has more than doubled in the last 20 years, doesn’t yield the same return on investment as it did a generation ago. Factor in student loan payments and young people can feel like they’re perpetually behind the financial eight ball.

But watching this viral video, I’m left with a question: While this parent was teaching her kids the importance of working hard, did she also wax poetic about how the world’s a scary place? That her kids need to prepare for life’s uncertainties, inequities, and rigged systems? That the only thing your sense of entitlement guarantees you is disappointment?

No? Just me?

As the daughter of Iranian immigrants who came to the states in the late 1970s to pursue…wait for it…The American Dream, this is the honest rhetoric I grew up with. And I think that message helped me as much (if not more) than my parents’ insistence that I strive for excellence and earn those academic degrees. It’s a lesson I intend to pass down to my children, too. Sure, working hard and “pulling yourself up by your bootstraps” are respectable efforts. They’ll pay off sometimes, but not always. More importantly, when things don’t go as planned, what’s your move going to be?

The sooner we recognize that nothing in life is guaranteed, and that nobody cares more about your money than us, the sooner we become our own best advocates and get creative toward finding new solutions. Some might call this having “grit” or “resilience.” I just say it’s being awake to the realities of the world we live in and planning accordingly.

It’s true that today’s young adults absolutely do have to endure more financial gymnastics than the previous generation, but it doesn’t mean they’re necessarily bound to their childhood bedrooms for eternity, either. Or that hard work is irrelevant.

My parents gave me everything I needed, including a healthy relationship with money anxiety. I’ll never forget the heartfelt message my mom gave me the day she and my dad dropped me off at Penn State freshman year: “If you get into any debt, Farnoosh, we won’t be here to help you.”

That was a terrifying concept to digest at 18 years old. Show me a college student who doesn’t have credit card debt, and I’ll show you a person who apparently never gets hungry for food.

But ultimately, I’m so grateful. My fear of not making it on my own set me on a course to learn how to make my own money — and fast. I worked multiple jobs, including an awful telemarking one where I had to sell coffee subscriptions to the elderly. (I got fired after getting caught secretly explaining to callers how to cancel after receiving an initial month of free beans — and keep the complimentary carafe.) I also got really good at lying to my parents about how I was “okay” when I was barely making those monthly credit-card minimums. Fear of failure, uncertainty, and falling prey to the system became my guiding forces. It led me to soldier through college and my 20s to piece together an independent life. (Full disclosure: I was on my parent’s cell phone plan until I was 24. Sue me.)

Perhaps that’s what this generation needs more of? Reminders about how life is truly hard and unpredictable, but that we can use our fears and disappointments as catalysts to mobilize ourselves anyway, somehow. So while we work to shift economic policies with our votes and through elections, we also become more creative in designing and rerouting our lives.

When things go financially haywire, you may need to surprise yourself and get uncomfortable for a while. This may entail moving far from your hometown, living with a handful of roommates, or bypassing the expensive city you’ve been dreaming of. It may mean renting for a lot longer than you’d planned before you buy a home. (If you ever do buy a home, and if you don’t, that’s totally fine in my book.) It may mean working multiple jobs.

So, yeah, hard work. Your path won’t look like your parents’. But then, when has that ever stopped us from doing anything?

Farnoosh Torabi is a financial expert, author, and host of the podcast So Money. Her forthcoming book is entitled A Healthy State of Panic: Follow Your Fears to Build Wealth, Crush Your Career and Win at Life