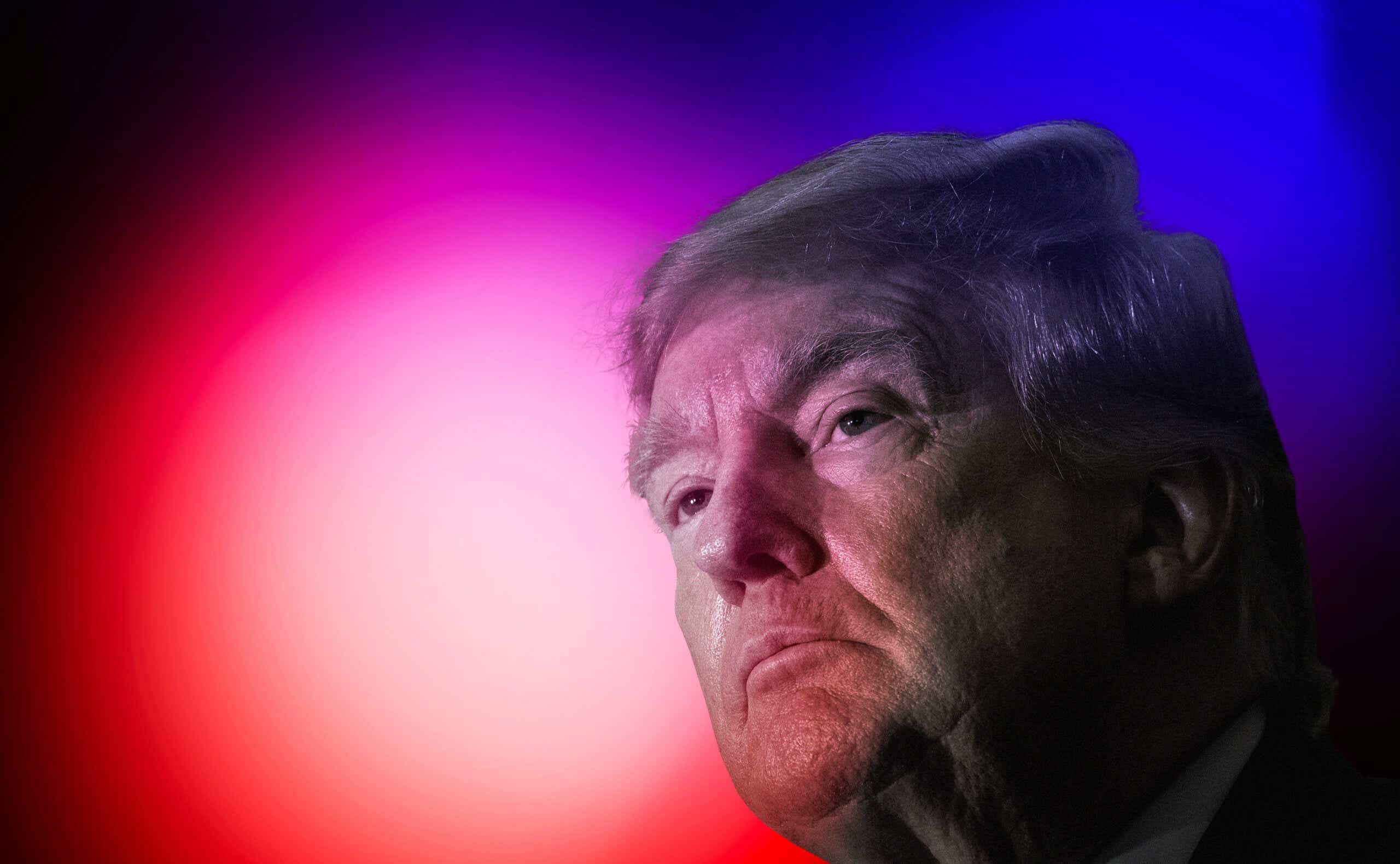

Former President Donald Trump’s company, the Trump Organization, was found guilty this week of tax fraud and other financial crimes. Here’s everything you need to know about the conviction.

Background on the Trump Organization Trial

The Manhattan district attorney’s office opened a criminal inquiry into Trump’s family business all the way back in 2018. The probe initially homed in on the hush-money payments Trump’s former attorney Michael Cohen paid to Stormy Daniels during the 2016 presidential campaign. But prosecutors later broadened their focus.

They uncovered the Trump Organization’s long history of providing lavish perks to its executives — from leased Mercedes to private school tuition — all off the books, the New York Times reports. The company was convicted on all 17 counts, including scheme to defraud, conspiracy, criminal tax fraud, and falsifying business records. The maximum penalty faced by the Trump Organization is just $1.62 million.

Who is Allen Weisselberg?

The case centered on testimony given by the Trump Organization’s long-serving chief financial officer Allen Weisselberg. He pleaded guilty in August to 15 counts including tax fraud. As part of a plea deal, Weisselberg agreed to testify against the company for a reduced sentence.

On the stand, he recounted how he and Trump Organization comptroller Jeffrey McConney schemed to cheat on state and federal taxes for 15 years. Prosecutors said Weisselberg and other execs received bonuses or other perks that weren’t reported as salary, in violation of tax laws. McConney and an outside accountant, Donald Bender, also served as witnesses in the trial and were granted immunity.

The company’s lawyers attempted to pin the blame on the former CFO, saying repeatedly: “Weisselberg did it for Weisselberg.” But prosecutors argued throughout the case that Trump was aware of the misconduct and sanctioned it.

What does it mean for Trump?

The former president was never indicted in the case, but he was mentioned throughout the trial and depicted by prosecutors as someone who fully endorsed the tax fraud.

The conviction also tarnishes the reputation of his high-profile company, which Trump has used to vault himself into the limelight as a tabloid celebrity and reality TV star. That may ultimately hurt his chances in 2024. And, the Times reports, it could help the Manhattan district attorney’s office in its broader investigation of Trump’s business practices.

Who else is investigating the Trump Organization?

New York Attorney General Letitia James began her own probe in 2019 and this fall filed a lawsuit against Trump, the Trump Organization, and his three children, Donald Jr., Eric, and Ivanka. The civil suit accuses them of lying to their insurers and lenders by inflating their company’s worth by billions in an act of “staggering” fraud.

James is seeking to bar the Trumps from ever running business in New York State again. The case is separate from another criminal probe led by the Manhattan district attorney’s office, which is also digging into allegations Trump and his company grossly overvalued its assets.