For homeowners, much of the pandemic felt like a frenzy of house makeovers. Locked down with nowhere to go and sitting on record savings, Americans refurbished their bathrooms, created open-concept kitchens, spruced up their patios, added home offices, and finally got around to mending that fence — en masse. They overran Home Depot and Lowe’s and even fueled a shortage in lumber. “We saw remodeling and repair just skyrocket,” says Abbe Will, a senior research associate at Harvard’s Joint Center for Housing Studies.

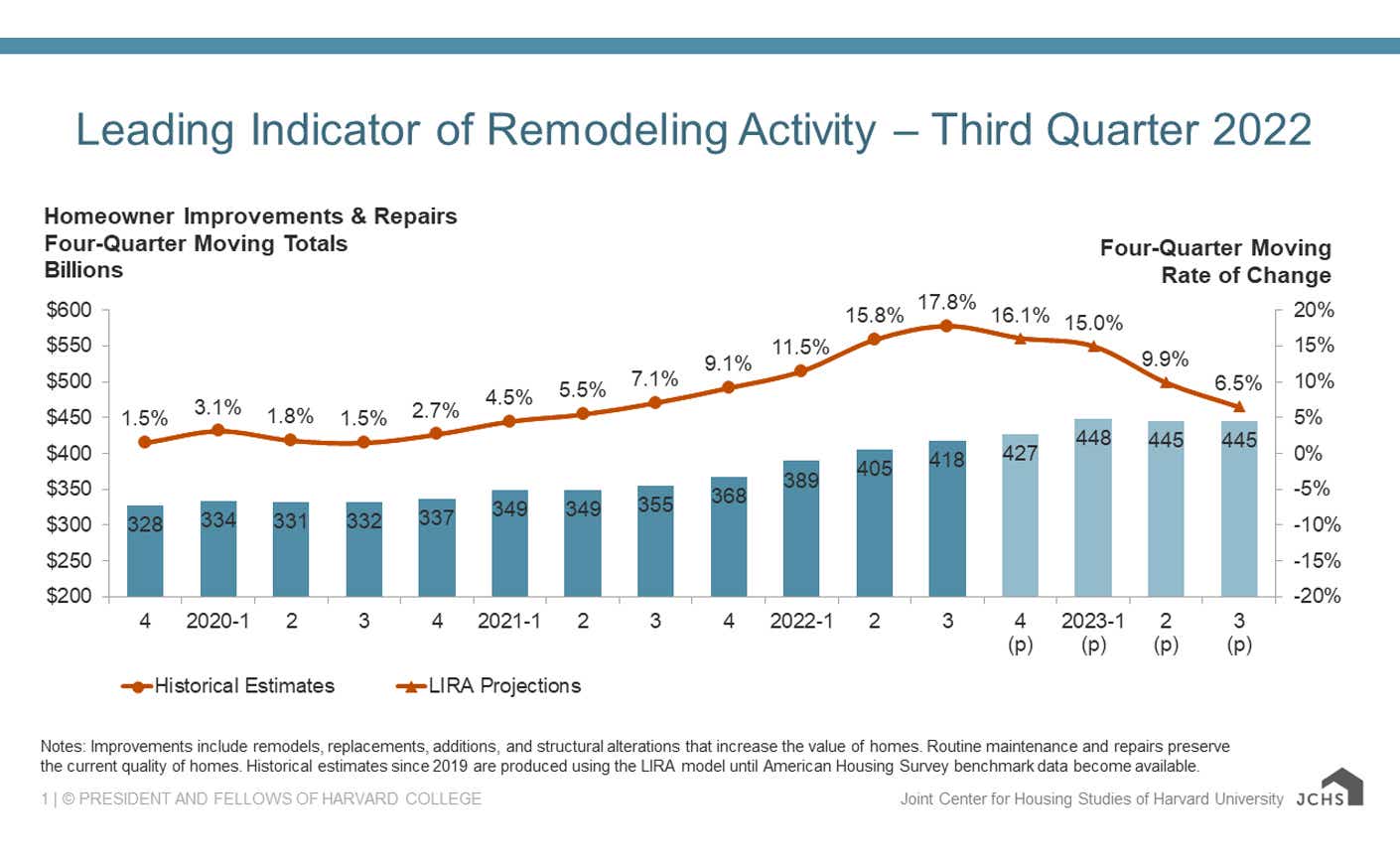

Homeowners spent $337 billion in improvements and repairs in 2020, $368 billion in 2021, and are projected to shell out $427 billion by the end of this year, according to data from the Joint Center for Housing Studies. But with a potential recession on the horizon, does it still make sense to invest in remodeling your home?

Explosive growth in the home-remodeling sector is expected to slow in the coming year, Will says. Spending is expected to grow by only 6.5 percent over the 12-month period ending in the third quarter of 2023, compared to 17.8 percent during the same period a year before. Homeowners may feel pinched by inflation and concerned about an economic downturn, making them less likely to take on big home-improvement projects, she says.

Is now a good time to take on a new house project? The answer’s not so clear-cut. The U.S. has long struggled with a shortage in trade labor, and that crunch only worsened during the pandemic. But with fewer people looking to renovate, it may be slightly easier next year to find the skilled labor needed to get your project off the ground. As it stands, Will says many contractors are still reporting backlogs of six to nine months. But with the drastic decline in new home construction — down to its lowest level in two years — that could free up some labor for remodelers, Will says.

The cost of materials, like wood, concrete, and steel, shot up over the past two years but has since fallen modestly, according to a report by the National Association of Home Builders. But it still remains well above pre-pandemic levels, says Koda Wang, CEO and co-founder of Block Renovation, a startup that streamlines the renovation process for homeowners.

Supply-chain issues are still a huge pain for remodelers, too. The situation might not be quite as bad now as it was earlier in the pandemic, “when you saw people waiting months and months for appliances, kitchen cabinetry, tiles, plumbing materials,” Wang says. These issues continue to persist, though it isn’t clear for how long. What is clear is that staying put and sprucing up your current digs is a much better option at the moment than buying a new home, says Wang.

Mortgage rates have shot up in 2023, hovering around 7 percent, compared to 3 percent a year ago, according to Freddie Mac. And as the Federal Reserve keeps raising rates, mortgages are expected to remain pretty pricey for a while. So some would-be homebuyers are now opting to make the most of what they have.

“It kind of changes the calculus,” Will says. “Folks might be much more willing and interested in investing in bigger and different projects in their home, knowing that they’re now going to be there for a longer haul than they may have originally intended.”

And a growing share of homes are likely in need of some TLC. The median age of an owner-occupied house in 2021 is 40 years, compared to 29 years in 2000, per Census Bureau data.

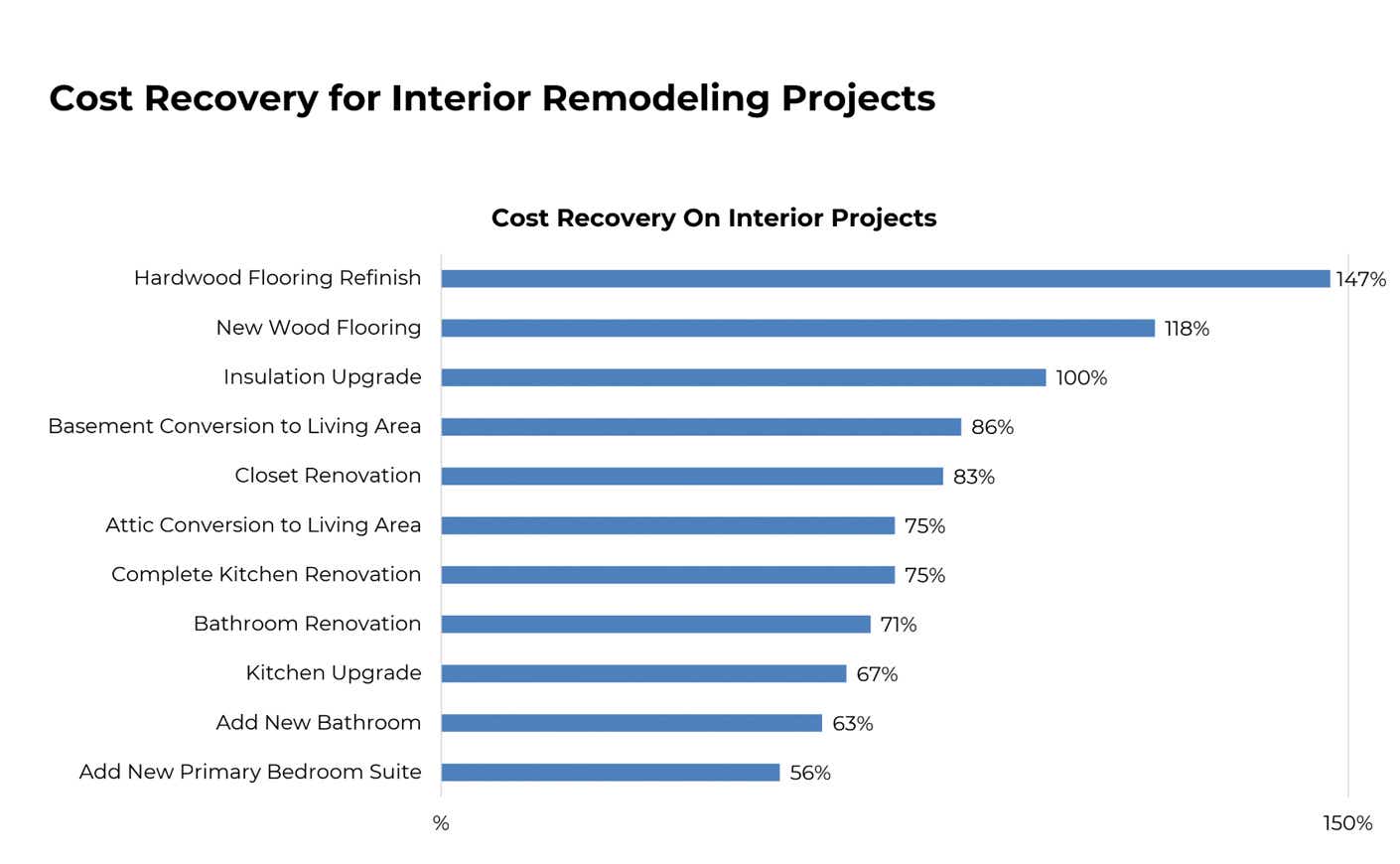

If you've been neglecting your honey-do list, Brandi Snowden, the National Association of Realtors’ Director of Member and Consumer Survey Research, says she thinks now is still a good time to get to work. Especially since even limited projects like refinishing your hardwood floors (at an average cost of $3,400) can reap a 147 percent return on investment, according to an April National Association of Realtors report. New wood flooring is also another worthwhile project. Per NAR, the average cost of replacing your wood floors is $5,500 while the estimated cost recovery is $6,500 (a 118 percent ROI). Homeowners can also expect to recoup 100 percent of what they spend on insulation upgrade, which has the added bonus of cutting the cost on your energy bills.

“It seems like people are continuing to take on these projects and make their homes more livable, or choosing to upgrade different finishes in their homes so they can stay there longer and really customize it to fit their own needs,” Snowden says.