According to director Robin Hauser, a lack of financial literacy is one of the biggest hurdles women in the U.S. face today. This knowledge gap can be attributed to a high percentage of women leaving financial decisions to their partners: “As time goes on," Hauser says, "the partner in charge of the finances becomes more and more financially literate, while the other partner is left in the dark.”

The good news is, it doesn’t have to be this way. In her new film $avvy, Hauser gets to the heart of why so many women have taken a backseat in their finances… and how to get them back in the driver's seat.

$avvy will be screening IN PERSON (!) at the Boulder International Film Festival on June 26th at 12:45 PM Mountain at the Century 16 Boulder. Virtual screenings are available June 24 through July 6.

KCM: The film opens with a shocking statistic— 56% of women and 61% of millennial women abdicate financial decisions to the men in their life. Did this surprise you, and why do you think this is?

Robin Hauser: That is the single most shocking thing that I learned by making this film. That's why we opened with that question — why are women, especially millennial women, abdicating their financial decisions? Some people think it's this Cinderella effect — that women just want to be taken care of. There’s also the history — it wasn’t until the 1970s that a woman could even get a credit card on her own. Then I think there's a social component — societal norms dictate that finance is male territory. I think that idea is explained really well in the film by Sallie Krawcheck, the CEO and co-founder of Ellevest, who explains that Wall Street was made by men for men. It wasn’t necessarily built to purposely exclude women, but everything about Wall Street, down to the anatomically correct (or possibly enhanced!) bull that symbolizes it, is meant to speak to men.

There's nothing wrong with division of labor in a partnership — both people can’t do everything. But in most cases, both partners come into a marriage with about the same level of financial literacy. As time goes on, the partner in charge of the finances becomes more and more financially literate, while the other partner is left in the dark. Too often in heterosexual relationships, the person left in the dark is the woman. For 25 years while I was married, I was not really in charge. I also wasn't the one bringing in money because I gave up my job to have kids. I can say from experience, it is so empowering to be in charge of my own money again.

The film asserts that the pay gap between women and men contributed to the toxic culture exposed by the #MeToo movement — how?

In the film, Sally Krawcheck asserts that we wouldn’t have needed the #MeToo movement if women had as much money as men do. Do you think these abusive men would have been able to do what they did if the women they were sexually abusing had as much money as they did? Absolutely not. Part of the problem is that the person making the decisions about a young woman’s career trajectory is too often a powerful man. It’s terrifying for anyone, but particularly a young woman just starting out in her career, to be faced with potentially losing their job, and for too long powerful men have used that fear as a means of manipulation. There is a huge connection between power and money, and whose hands the money is in. That’s not to say that there aren't some women in power that can be abusive, but I think having more women with power and money at the top would even the scales.

The film also confronts what is a very tricky subject for some couples — the prenup. You say every couple should have one — why?

Think about it as insurance. You get insurance for your car, or for your apartment, why wouldn’t you get insurance for a marriage? It doesn’t have to mean you're going into the marriage thinking about divorce, because of course that's not the mindset that you want to have when you've chosen who you think will be your life partner, but things happen, right? You have to protect yourself. I get that it might not be romantic, but I think we need to make it more commonplace across the board. Something like 51% of marriages end in divorce. So if you happen to fall into that statistic somewhere down the road, then at least it's going to be easier to part.

What I've noticed is that women that have amassed their own wealth want a prenup. But you have to remember — it's not just what you're bringing to the marriage. A prenup can also protect you against your partner’s debt. What if somebody has huge student loan debts that are suddenly yours? Think about what that does to your credit score.

One young woman in the film, Caitlin, explains how her parents took out high interest college loans on her behalf that she ended up having to pay off later. Can you tell us about her?

Caitlin’s adoptive father was a cop, and her mom stayed at home and took care of the kids. They weren't especially financially savvy because they'd never really been taught how to be. So when they realized that they had this very smart daughter, they wanted to get her the best education possible, and they fell prey to private student loans. As Caitlin says in the film, it was practically predatory lending. But her parents didn't know any better.

Part of the problem is the system — nobody teaches you how to navigate it. They likely could have negotiated the interest rates, or compared where to borrow from, but they didn't know to. Our educational institutions are so ridiculously expensive. With all of the compounding interest, Caitlin ended up with over $222,000 of debt for her undergrad and graduate degrees. Luckily she's incredibly bright, she got a really good job, and she negotiated her salary and was able to pay off her loans.

How can parents and kids start talking about financial literacy together, especially when it comes to a huge investment like college?

I think what happens is that there's a sense of pride with parents. When they know that their kid has gotten into college, or gotten into grad school, they really want to help and they don't want their kid to worry about the money. So they figure it out. Whether they put a second mortgage on the house, or get a second job, parents go to extreme measures to try to afford college for their kids. In Caitlin's case, I don't even know if she knew her parents were taking out these loans until afterwards.

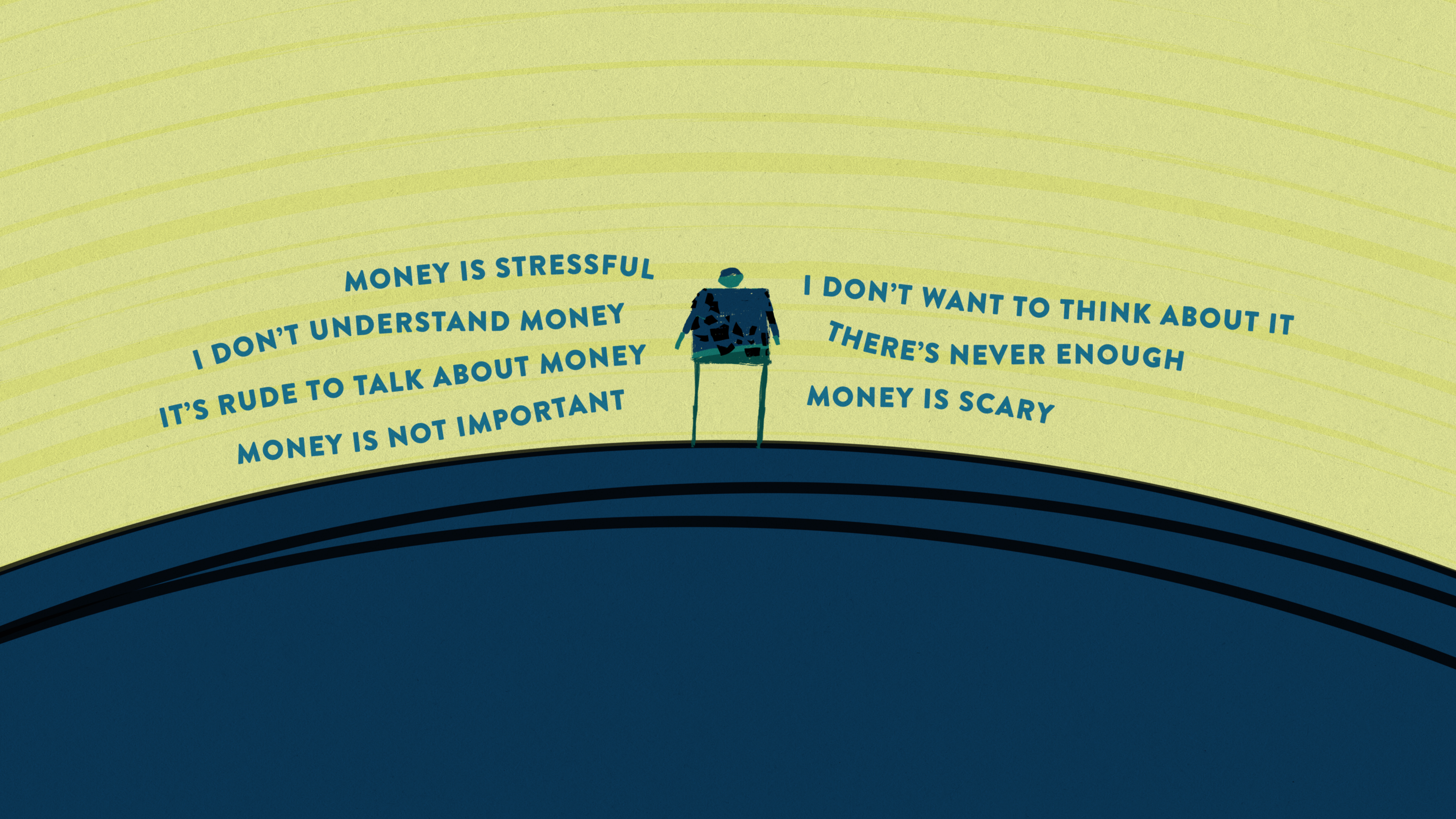

Talking about money shouldn’t be shameful, and it's never too early to start talking about money to your kids, because they aren’t going to learn it anywhere else. Make money talk normal in your household. For young women, if you’re not talking about saving and investing with your parents, or at school, or with your girlfriends, you’re just not going to learn about it. And then you get to a certain age where you start to feel shame, like “I really should've been paying more attention to this, I should have been contributing to my 401(k).”

One of the most compelling stories in the film is about a group of friends who started an investment club together almost 40 years ago. Will you tell us about them?

Yes! So this is a group of women who were all friends in 1983, and one of them inherited some stocks. She didn’t know what they were, or what to do with them, so she decided to start a club with her girlfriends, which they called the From Tennis to Stocks Investment Club. Most of the women will admit that at that point their husbands handled their money, so they had very little experience with finance or investing, but they learned together. In the film, they talk about how empowered they felt, and how proud of themselves they were. They felt emboldened by the fact that they were savvy — they understood the stock market and were aware of what was going on. They learned about how companies worked by researching companies to invest in. There were 16 members from the start, and now there are 14 surviving and they still meet today. I could have made a whole film just about them.

$avvy doc will be screening IN PERSON (!) at the Boulder International Film Festival on June 26th at 12:45 PM Mountain at the Century 16 Boulder. Virtual screenings are available June 24 through July 6.

Reported by Emily Pinto